Cryptocurrency works through blockchain technology, a distributed ledger recording transactions verified by currency holders. Units are created through mining, solving mathematical problems.

Credit: www.kaspersky.com

Cryptocurrencies like Bitcoin operate independently of banks, using encryption for secure transactions. Blockchain technology ensures transparency and security in recording asset transfers. As an alternative form of payment, crypto is stored in digital wallets for ease of use. Staking provides opportunities to earn passive income by assisting in transaction verification.

Cryptocurrency exchanges enable the conversion of digital assets into traditional fiat currencies, allowing for seamless cash withdrawals. Overall, cryptocurrency's decentralized nature and encryption algorithms make it a unique and innovative financial system reshaping the digital economy.

Intro To Cryptocurrency

Cryptocurrency operates through blockchain technology, a secure decentralized digital ledger tracking transactions. Mining, a process involving solving complex mathematical problems using computer power, generates cryptocurrency units. Staking also offers passive income opportunities. Using a cryptocurrency exchange, one can convert cryptocurrency into traditional fiat currency.

What Is Cryptocurrency?

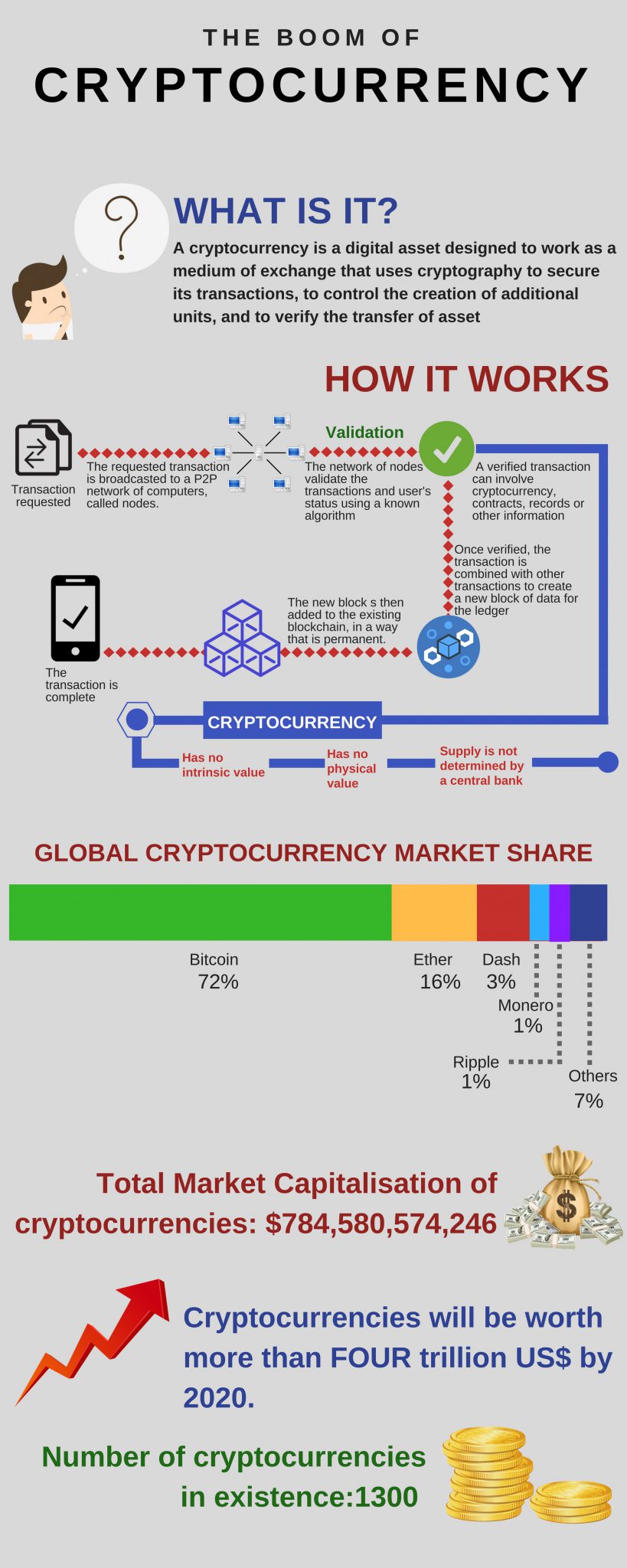

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of a central authority, such as a bank or government, making it decentralized and secure.

Brief History Of Cryptocurrency

Cryptocurrency has its roots in the Cypherpunk movement of the 1990s. The first cryptocurrency, Bitcoin, was introduced in 2009 by an unknown person or group known as Satoshi Nakamoto. Since then, numerous other cryptocurrencies have been created, each with its unique features and uses.

Functioning Of Cryptocurrency

The functioning of cryptocurrency is based on blockchain technology, mining process, and cryptocurrency wallets. Let's discuss each of these aspects in detail:

Blockchain Technology

Blockchain technology is the foundation of cryptocurrency. It is a decentralized ledger that records all transactions across a network of computers. Each transaction is represented as a block, which is added to the chain in a chronological order. This system ensures transparency and security as each block is linked to the previous one using cryptographic algorithms.

Mining Process

The mining process is how new cryptocurrencies are created and validated. Miners use powerful computers to solve complex mathematical problems, which confirms and adds new transactions to the blockchain. In return for their computational effort, miners are rewarded with a certain amount of cryptocurrency. This process also helps maintain the security and integrity of the blockchain network.

Cryptocurrency Wallets

A cryptocurrency wallet is used to store, send, and receive digital currencies. It consists of a public key and a private key. The public key acts as the address to which the cryptocurrency is sent, while the private key is used for authentication and access to the funds. It is essential to secure your private key as it grants full control over your cryptocurrency holdings.

Key Components Of Cryptocurrency

Cryptocurrency works through key components such as blockchain, a decentralized network for transaction verification, and cryptography for secure transactions. The process of "mining" involves solving complex mathematical problems to produce new coins, and the peer-to-peer network allows for seamless transactions without the need for a central authority.

Decentralization

One of the key components of cryptocurrency is decentralization. Unlike traditional currencies that are controlled by central banks or governments, cryptocurrencies operate on a decentralized network. This means that no single entity or authority has complete control over the currency. Instead, transactions are verified and recorded on a public ledger called the blockchain, which is distributed across a network of computers known as nodes. This decentralized nature ensures that there is no single point of failure and provides transparency and immutability to the transactions.

Security Features

Cryptocurrencies incorporate various security features to protect the integrity of transactions and the privacy of users. These security features include cryptographic algorithms and protocols that ensure the authenticity and confidentiality of transactions. Cryptography is used to secure the transfer of funds and verify the ownership of the cryptocurrency. Additionally, cryptocurrencies use digital signatures to validate and authorize transactions, preventing fraud and counterfeiting. The combination of these security features makes cryptocurrencies highly secure and resistant to hacking or tampering.

Transaction Anonymity

Anonymity is another crucial aspect of cryptocurrencies. While traditional financial transactions often require personal identification, cryptocurrencies provide a certain level of anonymity for users. When making a transaction using a cryptocurrency, users are identified by their public keys rather than their personal information. This ensures that transactions are confidential and protects the privacy of users. However, it is important to note that while transactions may be anonymous, the blockchain is publicly accessible and transparent, allowing anyone to view transaction histories.

Binary System

The binary system is the foundation of cryptocurrencies. Cryptocurrencies use a binary code to represent data and perform calculations. Binary code consists of only two digits, 0 and 1, which are used to represent various types of information, such as numbers, letters, and symbols. By utilizing the binary system, cryptocurrencies can store and process vast amounts of data efficiently. Additionally, the binary system enables cryptographic functions, which are crucial for securing and verifying transactions in the cryptocurrency network.

Credit: www.code-brew.com

Types Of Cryptocurrency

Bitcoin

Bitcoin, the pioneering cryptocurrency, operates on a decentralized network known as blockchain.

Ethereum

Ethereum is a versatile platform that enables smart contracts for various applications.

Ripple

Ripple stands out for its rapid transaction speeds and minimal fees within its network.

Litecoin

Litecoin is often referred to as the silver to Bitcoin's gold, offering faster transaction times.

Uses Of Cryptocurrency

Cryptocurrency has gained significant popularity due to its diverse range of uses. From facilitating secure payment transactions to offering investment opportunities and enabling the trade of NFTs and digital art, cryptocurrency has transformed the traditional financial landscape.

Payment Transactions

Cryptocurrency provides a seamless and secure method for conducting payment transactions. It eliminates the need for intermediaries such as banks and payment processors, leading to faster and more cost-effective transactions. Users can transfer funds across borders without the inconvenience of currency conversion or high transaction fees.

Investment Opportunities

Cryptocurrency presents lucrative investment opportunities for individuals and institutional investors alike. Through buying and trading various cryptocurrencies, investors can potentially earn substantial returns. Moreover, the emergence of decentralized finance (DeFi) platforms has opened up avenues for staking and yield farming, allowing investors to generate passive income through their crypto holdings.

Nfts And Digital Art

With the rise of non-fungible tokens (NFTs), cryptocurrency has revolutionized the art industry. Artists and creators can tokenize their works and sell them as NFTs on blockchain-based platforms, providing a secure and verifiable means of ownership and exchange. This has opened up a new marketplace for digital art collectors and enthusiasts.

Making Money With Cryptocurrency

Exploring the world of cryptocurrency isn't just about digital transactions; it's also about the potential to make money with cryptocurrency. There are various avenues in which individuals can engage in to grow their financial portfolios using cryptocurrency. Let's delve into some key methods:

Crypto Staking

With crypto staking, you can earn passive income by leveraging your cryptocurrencies to validate transactions on blockchain networks. While there are risks involved, staking presents an opportunity to expand your crypto holdings without additional investments.

Cryptocurrency Exchange

A cryptocurrency exchange is a digital platform where you can trade your Bitcoin or other virtual currencies for traditional fiat money like U.S. dollars. By creating an account on an exchange, depositing your cryptocurrency, and setting up a sell order, you can convert your digital assets into cash.

Challenges And Risks

Understanding the challenges and risks associated with cryptocurrency is crucial for investors and users alike. Despite its potential benefits, the crypto market is not without its drawbacks. Let's explore some of the significant challenges and risks:

Volatility

Cryptocurrency prices are highly volatile, experiencing rapid and significant fluctuations within short periods. This price volatility can lead to substantial gains or losses for investors in a matter of days or even hours.

Regulatory Issues

The regulatory landscape surrounding cryptocurrencies is complex and constantly evolving. Regulatory uncertainty can impact the legitimacy and widespread adoption of cryptocurrencies, leading to legal challenges for users and businesses.

Cybersecurity Threats

Cybersecurity threats pose a significant risk to the security of cryptocurrency transactions and storage. Hacking incidents and fraudulent activities can result in the loss of funds or sensitive information, highlighting the importance of robust security measures.

Future Of Cryptocurrency

Cryptocurrency works through a decentralized technology called blockchain, where transactions are verified and recorded by users on the network. It eliminates the need for intermediaries like banks and offers a secure and transparent method of transferring digital assets.

Adoption Trends

In recent years, cryptocurrency has gained significant attention and adoption worldwide. Its potential to revolutionize the financial industry has attracted individuals, businesses, and even governments. Adoption trends show a promising future for cryptocurrencies, indicating their growing popularity and acceptance. One of the key factors driving the adoption of cryptocurrencies is their decentralized nature. Unlike traditional currencies that are controlled by central banks, cryptocurrencies operate on a decentralized network known as the blockchain. This means that transactions are verified and recorded by multiple participants, making them highly secure and transparent. Moreover, cryptocurrencies offer several advantages over traditional financial systems. They enable faster and cheaper cross-border transactions, eliminating the need for intermediaries such as banks. This not only reduces transaction costs but also enhances financial inclusivity, allowing individuals without access to traditional banking services to participate in the global economy. Furthermore, the increasing acceptance of cryptocurrencies by businesses has contributed to their adoption. Major companies such as Microsoft, PayPal, and Tesla now accept cryptocurrencies as a form of payment, giving them additional credibility and fueling their mainstream usage. This acceptance has also extended to various sectors, including e-commerce, travel, and gaming, providing users with diverse options to utilize their digital assets.

Influence On Traditional Finance

The rise of cryptocurrencies has significantly impacted the traditional finance industry, challenging its conventional practices and systems. This disruptive influence can be attributed to various factors that cryptocurrencies bring to the table. One notable impact is the potential to redefine the concept of money. With the emergence of cryptocurrencies like Bitcoin and Ethereum, which are not backed by any physical asset, the notion of value has shifted from tangible objects to digital tokens. This has sparked debates and discussions around the nature of money and its role in the economy. Cryptocurrencies have also introduced new investment opportunities and financial instruments. Initial Coin Offerings (ICOs) allow startups to raise funds by issuing tokens, providing investors with early access to potential future gains. Additionally, decentralized finance (DeFi) platforms enable users to lend, borrow, and trade digital assets without the need for intermediaries, revolutionizing traditional banking and investment services. Moreover, cryptocurrencies have forced traditional financial institutions to reevaluate their approach to security and privacy. With the use of blockchain technology, cryptocurrencies offer enhanced security features, making them resistant to fraud and manipulation. This has prompted banks and other financial entities to explore the integration of blockchain into their existing systems, seeking to improve their security measures and customer trust. Overall, the increasing adoption of cryptocurrencies and their disruptive influence on traditional finance indicate a future where digital assets play a significant role in the global economy. As more individuals and institutions recognize the potential of cryptocurrencies, it is likely that further advancements and innovations will shape the financial landscape in the years to come.

Credit: www.researchgate.net

Frequently Asked Questions

How Does Crypto Make You Money?

Crypto can make you money through staking, where you use your crypto to verify transactions on a blockchain, growing your holdings.

How Does Cryptocurrency Work For Beginners?

Cryptocurrency works through blockchain technology, a decentralized and secure network for transactions. Mining solves complex math problems to create coins. Transactions are verified and recorded on a blockchain, an immutable ledger that tracks assets and trades. You can use cryptocurrency for purchases or as an investment.

How Does Cryptocurrency Turn Into Real Money?

To turn cryptocurrency into real money, use a cryptocurrency exchange to trade or sell for fiat currency, like US dollars. Create an account, deposit your cryptocurrency, set up a sell order, and withdraw the cash once filled.

How Does Cryptocurrency Work Technically?

Cryptocurrency is digital currency using encryption and a blockchain to function as both payment and accounting system.

How Does Cryptocurrency Work For Beginners?

Cryptocurrencies run on a distributed public ledger called blockchain, a record of all transactions updated and held by currency holders.

How Does Cryptocurrency Turn Into Real Money?

A cryptocurrency exchange allows you to trade or sell your Bitcoin for fiat currency, such as U. S. dollars or other traditional currencies.

How Does Cryptocurrency Work Technically?

Cryptocurrency is a digital currency created using encryption algorithms, functioning both as a currency and virtual accounting system.

How Does Crypto Make You Money?

Some cryptocurrencies offer the opportunity to earn passive income through a process called staking, where your cryptocurrencies are used to verify transactions on a blockchain protocol.

What Is Cryptocurrency Mining?

Cryptocurrency mining is a process involving the use of computer power to solve complex mathematical problems that generate new coins.

Where Can You Use Crypto?

You can use cryptocurrency as a form of payment in various online platforms and some physical stores that accept digital currencies.

Conclusion

Understanding how cryptocurrency works opens a world of innovative possibilities. Dive into this dynamic realm, fueled by blockchain technology and decentralized transactions. Embrace the future of finance and technology with cryptocurrency's secure, transparent, and adaptable framework. Start navigating the digital currency landscape with newfound insight and confidence.